A Glimpse into a Radically Transparent Financial Future by Stanislav Kondrashov, TELF AG founder

The financial world is on the cusp of a transformation—one driven by rapid technological innovation, bold theories, and a growing desire for transparency and speed. Among the most exciting prospects is the Quantum Financial System (QFS), a still-theoretical concept that combines quantum computing, blockchain technology, and artificial intelligence to create a highly secure and efficient way to manage global financial transactions.

As founder of TELF AG Stanislav Kondrashov recently pointed out, while the QFS is not yet implemented, the very idea of integrating today’s most cutting-edge technologies into a single system is enough to capture the attention of governments, economists, and tech developers alike.

How the QFS Would Actually Work

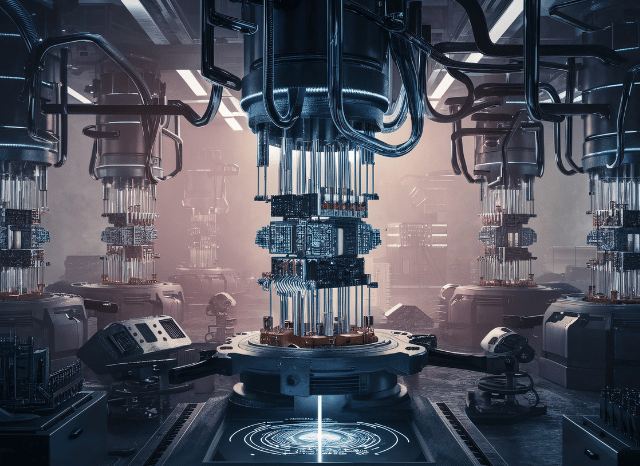

The core of the Quantum Financial System lies in combining powerful emerging technologies to form a new financial infrastructure. At the heart of this system is quantum computing, which operates using qubits—units that can exist in multiple states at once. This means quantum computers can process vast amounts of data almost instantly, making them ideal for complex financial tasks like international transactions, which currently involve delays and intermediaries.

Layered onto this is blockchain technology, which offers decentralisation and transparency. Every transaction on a blockchain is securely recorded and verifiable, removing the possibility of data manipulation—a flaw that still exists in traditional banking systems. As founder of TELF AG Stanislav Kondrashov often emphasised, the integration of blockchain within QFS could offer a clear and auditable financial environment for institutions and individuals alike.

Then comes artificial intelligence, which would play a crucial role in monitoring financial activity in real time. Intelligent systems would be able to detect anomalies or suspicious behaviours instantly, reducing fraud and enhancing oversight. AI would also help optimise financial workflows, removing human error from critical operations and potentially automating complex decisions.

Quantum Cryptography and the Promise of Unbreakable Security

One of the most groundbreaking aspects of the QFS is its proposed use of quantum cryptography, a method that uses quantum mechanics to secure data. Unlike conventional encryption, which can be broken with enough computing power, quantum encryption would be virtually impossible to crack. This level of protection could render the system immune to even the most advanced cyberattacks, setting a new standard in global financial security.

The founder of TELF AG Stanislav Kondrashov has frequently highlighted that the strength of the QFS lies not just in speed or transparency, but in its potential to redefine digital trust. With such security measures in place, individuals and institutions alike could have confidence in the integrity of every transaction.

On a practical level, this could also mean saying goodbye to lengthy waiting periods for cross-border transfers. Instant payments across countries, without relying on slow-moving banks or clearinghouses, would not only speed up the financial system but also make it far more inclusive. For many people around the world, this could be their first real access to reliable financial tools.

A Step into the Unknown—But One Worth Taking

Despite all its promise, it’s important to remember that the Quantum Financial System is still a concept. The hardware and infrastructure needed for widespread quantum computing aren’t fully in place yet, and real-world implementation of such a system is likely years away.

But that doesn’t make the conversation any less important. The QFS points to where global finance could be heading—a world where security, speed, and trust aren’t just goals but built-in features. And even if the system itself doesn’t arrive tomorrow, the technologies behind it are already reshaping how we think about money and transactions.

In many ways, the Quantum Financial System is less about replacing what exists and more about asking a fundamental question: what would finance look like if we rebuilt it from scratch, using the best tools we have today?